MEIF II - Debt Finance East and South East Midlands

Debt finance from £100,000 to £2 million for SMEs located across the East and South East Midlands.

About the Fund

MEIF II - Debt Finance East and South East Midlands is part of the £400 million Midlands Engine Investment Fund, one of a series of Nations and Regions Investment Funds launched by the British Business Bank which will deliver a £1.6 billion of new funding to smaller businesses across the UK.

MEIF II - Debt Finance East and South East Midlands is designed to transform the finance landscape for smaller businesses to enable them to access business loans from £100,000 to £2 million to support growth.

Take the next step in your growth journey

Loans from £100,000 to £2 million

Flexible debt solutions tailored to the needs of each company.

Available for SMEs across the East and South East Midlands

Available to businesses located in the East and South-East Midlands who are looking to raise debt for a range of funding requirements.

Debt finance to support growth

Funding packages can be tailored to individual business needs and growth strategy.

Aimed at existing businesses

Funding is available for existing, cash generative businesses operating in most sectors.

Helping you grow your business

MEIF II - Debt Finance East and South East Midlands can support a wide range of business finance needs including:

Improving available working capital

Purchasing new machinery

Capital Expenditure

Export Finance

Investing in new products

Growing your team

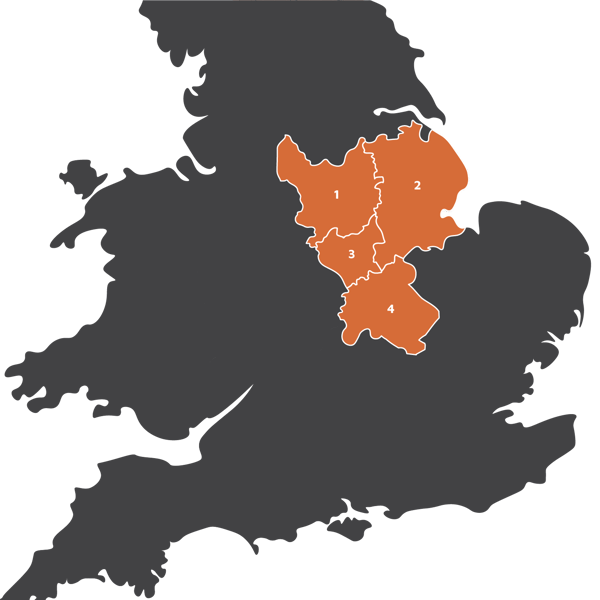

The MEIF II region

MEIF II - Debt Finance East and South East Midlands covers the following areas across the Midlands:

1: Derbyshire and Nottinghamshire

Amber Valley, Ashfield, Bassetlaw, Bolsover, Broxtowe, Chesterfield, Derby, Derbyshire Dales, Erewash, Gedling, High Peak, Mansfield, Newark and Sherwood, North East Derbyshire, Nottingham, Rushcliffe, South Derbyshire

2: Lincolnshire and Rutland

Boston, East Lindsey, Lincoln, North East Lincolnshire, North Kesteven, North Lincolnshire, South Holland, Rutland, South Kesteven, West Lindsey

3: Leicestershire

Blaby, Charnwood, Harborough, Hinckley and Bosworth, Leicester, Melton, North West Leicestershire, Oadby and Wigston

4: South East Midlands

Bedford, Central Bedfordshire, West Northamptonshire, Luton, Milton Keynes, North Northamptonshire

To check which local authority your business is located in, see www.gov.uk/find-local-council

Latest news & insights

News

Immersive technology company receives MEIF II debt funding

News

Immersive technology company receives MEIF II debt funding

News

Maven backs IP law firm with MEIF II debt funding

News

Sports hospitality specialist secures six-figure funding from MEIF II

Insights

Key considerations for business success

Case study

Funding through MEIF Maven Debt Finance drove Maeving's initial growth

Meet the local team

Our investment executives have the local connections, multi sector experience and national reach to help management teams build stronger and more resilient businesses.

No matches

Frequently asked questions

What is the Midlands Engine Investment Fund II?

Operated by the British Business Bank, the £400m Midlands Engine Investment Fund II covers the whole of the Midlands and provides debt finance from £25k to £2m and equity investment up to £5m to help a range of small and medium-sized businesses to start up, scale up or stay ahead. The Fund will increase the supply and diversity of early-stage finance for smaller businesses in the Midlands, providing funds to firms that might otherwise not receive investment and help to break down barriers in access to finance.

What is the purpose of the Midlands Engine Investment Fund II?

The purpose of the Midlands Engine Investment Fund II is to drive sustainable economic growth by supporting innovation and creating local opportunity for new and growing businesses across the Midlands.

Who can apply for funding?

Small and medium-sized businesses looking to scale up based in the East and South East Midlands region can apply for funding.

What types of funding are available?

As Fund manager, Maven can offer debt finance from £100k - £2m for SMEs located across the East and South East Midlands-SMEs.

What is the repayment period for finance provided through MEIF II?

Loans are repayable over 1-5 years. The repayment period will vary depending on the specific terms of the agreement. The Maven team will discuss repayment terms with you during the application process.

What are the eligibility criteria for funding?

To be eligible for funding, SMEs must be based in the East and South East Midlands region and have growth potential. They must also demonstrate a viable business plan and be able to demonstrate how the funding will help them achieve their growth ambitions.

Who can I contact for further information?

You can contact the Midlands team directly or by emailing meif-enquiries@mavencp.com for further information.